For the Record: Brokerage leadership edition (June 2025)

In this issue

RECO's first newsletter dedicated to brokerage leadership

Welcome to the inaugural issue of For the Record: Brokerage leadership edition

This regular publication has been designed specifically for brokerage leadership. Our goal is to feature informative and educational articles to help you manage your brokerage effectively and support your real estate agents.

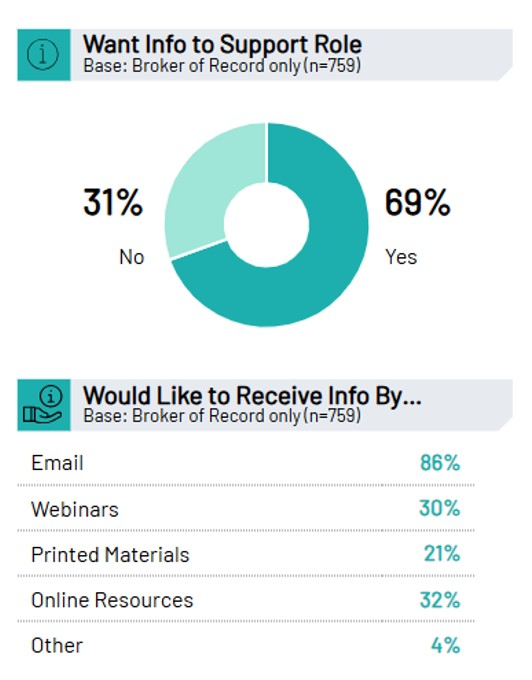

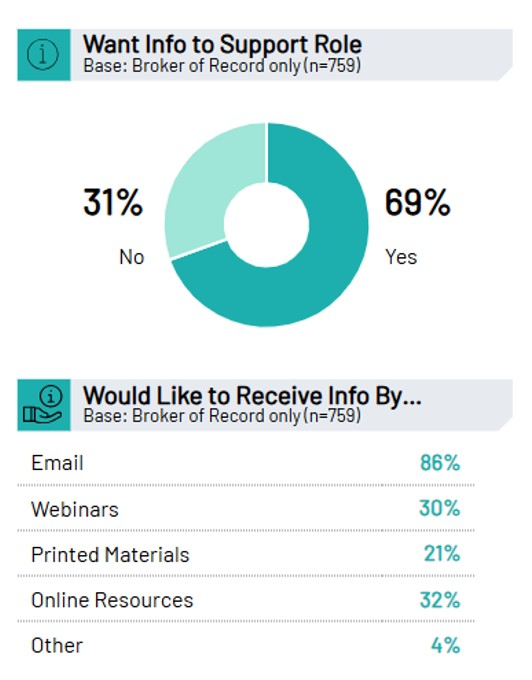

In the 2024 RECO registrant survey, approximately 70 per cent of brokers of record wanted to receive information from RECO to support them in their role, and 86 per cent preferred to receive information by email. Your feedback matters, so thank you for participating in RECO’s 2024 registrant survey. If you didn’t get a chance to share your thoughts last time, now is your opportunity—the 2025 RECO registrant survey is open until July 1. Please check your email for your invitation to participate.

It’s also worth highlighting that the feedback aligns with input shared by:

- RECO’s Industry Advisory Council: This group is made up of representatives from the real estate sector, all of whom are RECO registrants. They are charged with providing input to RECO’s board and management on key issues. Visit RECO’s Industry Advisory Council web page for more information.

- Local real estate boards: All executive officers of local real estate boards across Ontario are invited to participate. RECO seeks input from them twice annually. This feedback is invaluable in supporting RECO’s efforts to provide the information the real estate sector needs to comply with the law.

We want to hear from you about this newsletter.

If you have feedback, ideas, or requests for specific content that you would like to see in future editions of this newsletter, we would love to hear from you. Please email RECOstakeholderrelations@reco.on.ca.

Broker of record: it’s more than just a title–it's your responsibility

The broker of record is the key figure in a brokerage, with ultimate responsibility for overseeing all trading activities. This role involves ensuring compliance with regulatory requirements, maintaining operational integrity, and verifying that all transactions conducted are compliant with the law.

While brokerages may employ administrative staff or delegate tasks to qualified professionals for daily operations, these duties should only be assigned to individuals with the necessary expertise. The broker of record is responsible for ensuring that all staff are well-trained and fully understand the regulatory environment. Regardless of any delegation, the broker of record retains ultimate responsibility.

In some instances, the broker of record may also be accountable to shareholders or business partners. However, the presence of these stakeholders should not compromise the lawful and ethical operation of the brokerage. Under the law, the broker of record is obligated to act in the best interests of clients and prioritize compliance.

Additionally, the broker of record oversees all conduct of representatives within the brokerage, including salespersons, brokers, and administrative staff.

The broker of record is solely responsible for authorizing and monitoring withdrawals from the brokerage’s trust accounts. This requires the implementation of robust internal controls, monthly reconciliations, and meticulous record-keeping.

Common compliance issues

RECO conducts inspections of brokerages in Ontario to ensure compliance with regulations. To help you prepare for inspections, RECO is sharing information about common compliance issues. This will enable you to address these concerns in advance and ensure they are not present during your next inspection.

These are:

- Incomplete or inaccurate trust account reconciliations: Brokerages must conduct monthly reconciliations of their real estate trust account. Any discrepancies or errors identified during this process must be promptly investigated and corrected to avoid significant issues and ensure proper oversight.

- Failure to remit unclaimed trust funds to RECO: Brokerages are required to hold unclaimed trust funds for a maximum of two years. If the entitlement is unknown after this time or the entitled party cannot be located, the money must be remitted to RECO, as required by the Trust in Real Estate Services Act, 2002. The money must be remitted to RECO even in cases where the funds are the subject of ongoing litigation. When the litigation is resolved, the money may be requested from RECO.

- Incomplete representation agreements: All representation agreements must clearly describe the services being provided to clients. Documentation is to be clear and comprehensible, and for designated representation agreements, the agreement is to specify the services to be provided by the designated representative(s). Including the services to be provided and possibly those that are not, could reduce the chance of confusion or disagreements later.

In summary, the broker of record is responsible for ensuring the brokerage is compliant with all its legal obligations, and for promoting the professionalism of the sector—and must remain vigilant. Failure to comply with legal obligations could result in regulatory action being taken against the brokerage and/or the broker of record.

Discipline learning: failure to reconcile real estate trust account

To promote learning from recent enforcement actions, RECO will highlight issues of interest that demonstrate where or how a brokerage failed to comply with the legislation—and what can be done to ensure compliance.

Significant fine for failure to complete real estate trust account reconciliations

A brokerage was recently fined $9,000 for failing to complete its monthly real estate trust account (RETA) reconciliations. The fine represents $3,000 for each of the three months when the brokerage failed to complete its reconciliations. The brokerage in this case failed to reconcile the RETA over several consecutive months, which resulted in its failure to:

- identify erroneous transactions within the account, indicating a lack of oversight and internal controls;

- identify and rectify shortfalls in the trust account over multiple reconciliation periods; and

- notify RECO of these shortfalls.

Every brokerage is responsible for completing a monthly reconciliation of its RETA, which is a regulatory requirement. A broker of record may employ or hire a qualified professional to prepare its reconciliations. The broker of record remains responsible for reviewing the information and must sign and date all reconciliations within 30 days after the last day of each month. Failure to meet this obligation can lead to serious consequences, including regulatory penalties and potential harm to consumer trust.

Recent brokerage inspections also identified instances where brokerages failed to detect significant issues, such as:

- deposits that were never received but recorded and disbursed;

- cheques that were cashed twice through mobile deposit; and

- administrative errors that related to the deposit or withdrawal of trust funds.

While mistakes will occasionally occur because of human error, delays in identifying and addressing them only make resolution more complex and time-consuming. Prompt, accurate reconciliation is the best tool a brokerage has to identify and remedy issues early and reduce risk.

It is important to emphasize that the obligation to reconcile applies to all brokerages regardless of the balance in the trust account. A brokerage that does not hold deposit funds during a reconciliation period would simply report $0 on its reconciliation.

This case serves as a reminder that proper trust account reconciliation is not only a regulatory requirement, but a professional obligation that protects the brokerage and the interests of consumers it represents.

Reporting requirement: mandatory annual reporting for unclaimed trust money

A broker of record is required to declare annually whether the brokerage is in possession of any unclaimed trust money that:

- has been in its possession for more than two years; and

- for which entitlement has not been determined or is unclear, or the entitled person(s) cannot be located.

This declaration is done on both the brokerage renewal application, and via an online form response in the non-renewal year.

Here’s how it works:

At renewal: As part of the Brokerage Renewal Application—Section E, brokers of record answer a question to declare whether the brokerage is in possession of any unclaimed trust monies (every two-year cycle).

Annually (month of renewal in non-renewal year): When the non-renewal declaration is required, brokers of record will receive an email with a link to an online declaration form. The email is sent monthly to brokerages at the mid-point of the two-year registration cycle and includes directions for remittance and a spreadsheet that is required to be completed documenting the details of any unclaimed trust monies being remitted to RECO.

The declaration must be completed annually, even if no unclaimed trust monies are held.

Brokers of record are advised to complete the declaration as soon as they receive the email to avoid any delays and additional reminders. If you have any questions, please contact registration@reco.on.ca.

Brokerage registration: watch for these top deficiencies

Brokerage renewals happen on a two-year cycle. It is important to note that, as per the legislation, any change to information previously provided in an application must be reported to RECO within five days, and not just at the next renewal.

Compliance with your reporting obligations is ongoing throughout your registration cycle.

Brokers of record should be aware of the top deficiencies that are commonly identified at renewal time:

- Application signature: For all business applications, Section A of the application must be signed by the broker of record.

- Notifications not made to RECO within specified times:

- Brokers of record must notify RECO of any changes to the real estate trust account, address, and any change to the designated broker of record, within five days of the change.

- Name change: Brokerages must notify RECO if their brokerage name changes within five days of the change.

- Transfer of shares: Brokerages must notify RECO of a change to the issue or transfer of shares within 30 days of the change.

Visit RECO's website for additional information and forms.

Update: printer-friendly guides and the RECO Information Guide online sharing tool

Thanks to registrant feedback, we are pleased to announce that new black and white, printer-friendly versions of the versions of the RECO Information Guide have been created for those of you who want to produce a printed version or have clients who want to print it for themselves.

Our printer-friendly guides include:

• RECO Information Guide (Residential - printer-friendly version)

• Guide d'information du COI (Résidentiel - version imprimable)

• RECO Information Guide (Commercial - printer-friendly version)

• Guide d'information du COI (Commerciale - version imprimable)

As well, the RECO Information Guide online sharing tool has a new home on RECO’s primary website. The move is part of our recent brand refresh while maintaining the functionality of the current sharing tool that you rely on.

Be sure to bookmark: reco.on.ca/recoinformationguide

Providing services to clients in a rental transaction

While RECO does not have access to transaction data, there has been anecdotal indications that more landlords and tenants are engaging real estate agents to represent them in rental transactions. Though RECO has received relatively few complaints related to rental transactions, it is important for brokerage leadership to understand their obligations.

The rights and responsibilities of real estate agents are governed by the Trust in Real Estate Services Act, 2002 (TRESA) and agents must comply with the law. In other words, agents and brokerages have the same obligations under the law in a rental transaction as they would for a purchase or sale, including those that follow.

Clarity in representation

- Individual representation of either a tenant or a landlord in a rental transaction makes it very clear whose interests the agent is to be promoting and protecting.

- This is done through a representation agreement, which must be in place when an agent represents a party in any transaction—including in rental transactions.

- Remember that an agent or brokerage is prohibited from representing two clients in a transaction, unless the required disclosures have been made, and the clients or prospective clients make an informed decision whether to proceed.

Disclosure of services

- Agents and brokerages must outline all the services they will provide when acting for a client in a rental transaction, regardless of whether the client is the tenant or the landlord.

- The services can vary, but the important aspect is that both the agent/brokerage and client have a clear understanding of the specific services that are to be provided under the agreement. This could be services such as negotiating the terms of the lease, completing the standard Ontario lease agreement, showing the rental property, or screening tenants.

- It is just as important to outline what the client is responsible for—or at a minimum, make it clear what the brokerage/agent are not providing—to avoid misunderstandings.

- All services must be outlined in plain language so that clients can understand what they can expect the agent/brokerage will do.

Disclosure of fees

- The representation agreement is to include clear and complete details of the compensation and who is required to pay the compensation.

Remember: The RECO Information Guide must be given to a client and explained before any services are provided and to a self-represented party before assistance is provided.

RECO provided more about registrant obligations in rental transactions in its quarterly For the Record newsletter in October 2024 and again in December 2024.